Introduction

It’s no secret that more eyes are on the recommerce industry than ever before. While apparel-specific marketplaces are making headlines, the resale market is about much more than just clothes. Nearly half (48%) of Americans purchased items from a resale marketplace last year and one in five adults used OfferUp in 2020. With more people spending the majority of their time at home, the apparel resale category had its worst year on record, but furniture and home goods resale boomed.

Last year, our homes became the place for work, school, exercise and play. As Americans prioritized spending on their homes, they still wanted to save money, explore interesting designs and shop sustainably. So it’s no surprise that resale marketplaces became the go-to destination for items like desks, exercise equipment, gaming consoles and work-from-home essentials like monitors and computers.

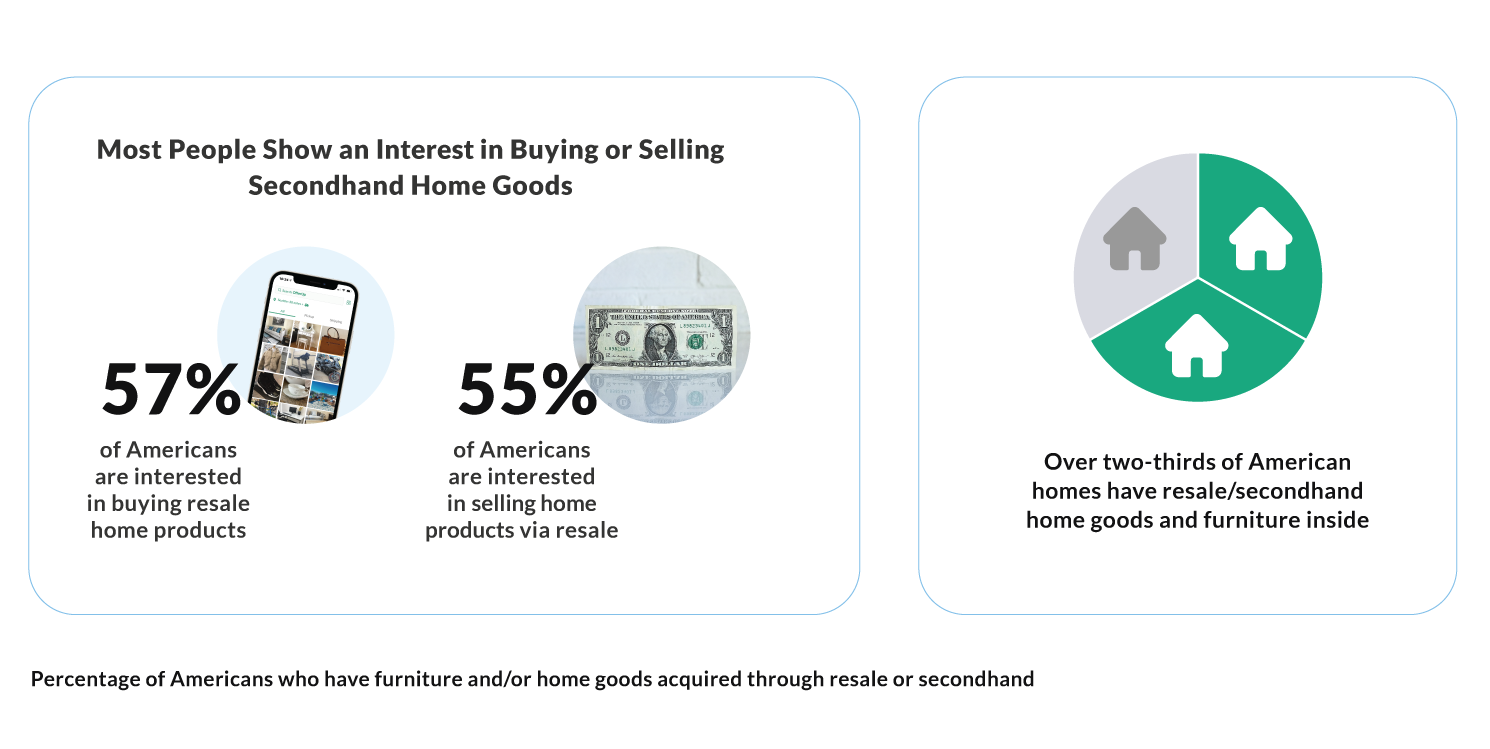

According to our third annual Recommerce Report, 35% of Americans purchased home products in 2020 on resale apps, making it the fastest-growing retail channel for home-related items.

While the convenience of technology helped drive more people to shop online during quarantines, our 2021 report shows that Americans have also found resale to be frequently less expensive and better for the environment than traditional retail. Industry and cultural trends show that recommence is here to stay and is an increasingly integral part of our lives.

OfferUp is the largest mobile marketplace for local buyers and sellers in the U.S., and we are still growing at a rapid pace. Last year we acquired letgo to create a combined U.S. marketplace with more than 56 million yearly buyers and sellers. We’ve seen new growth in items posted and sold across our major categories, from autos to electronics.

2020 proved what we’ve always known at OfferUp — the future of recommerce includes fashion, but also so much more of the things we find critical to our day-to-day lives.

Cheers,

You can download a PDF of our report here

+++

Key Findings At a Glance

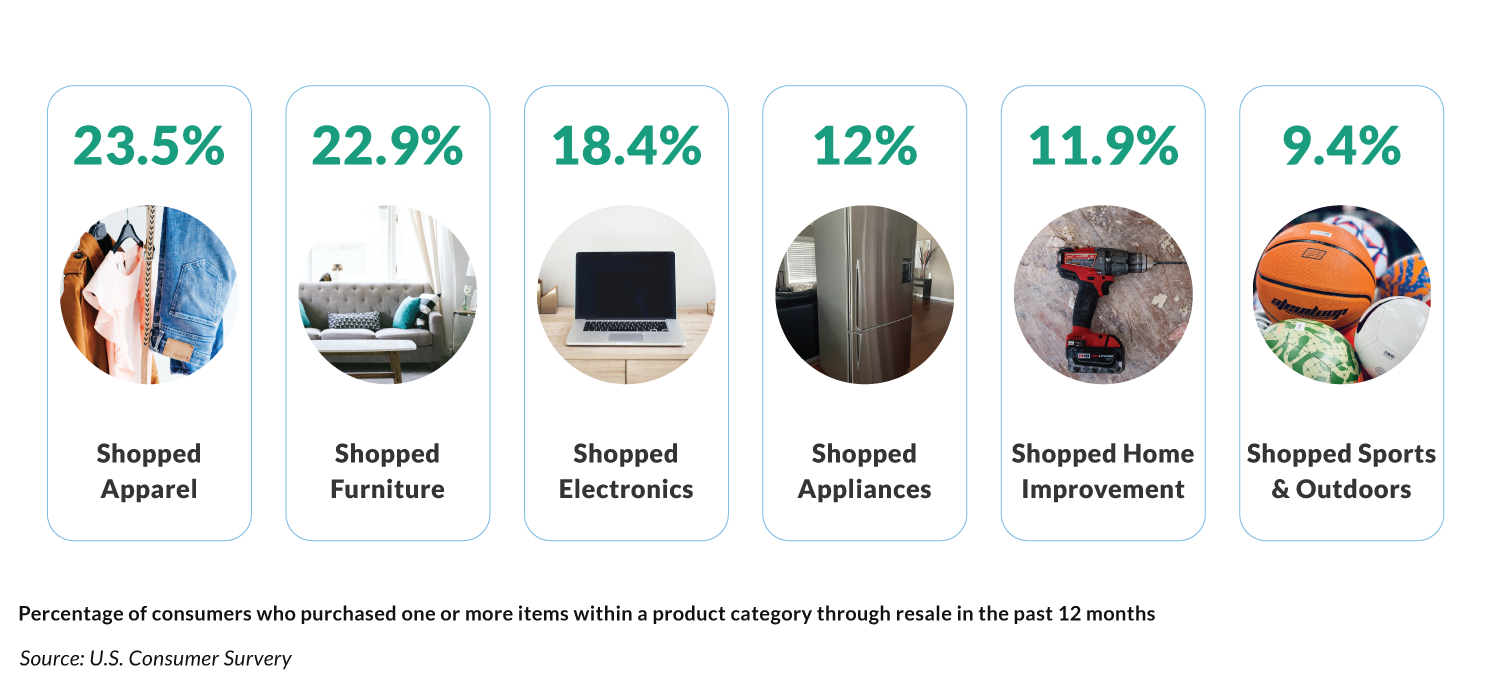

People Are Buying Through Recommerce More Than Ever Before

In 2020, nearly half (48%) of Americans bought something on a resale marketplace

While apparel was the most purchased category from resale marketplaces in 2020, furniture and home goods followed closely behind with 23%

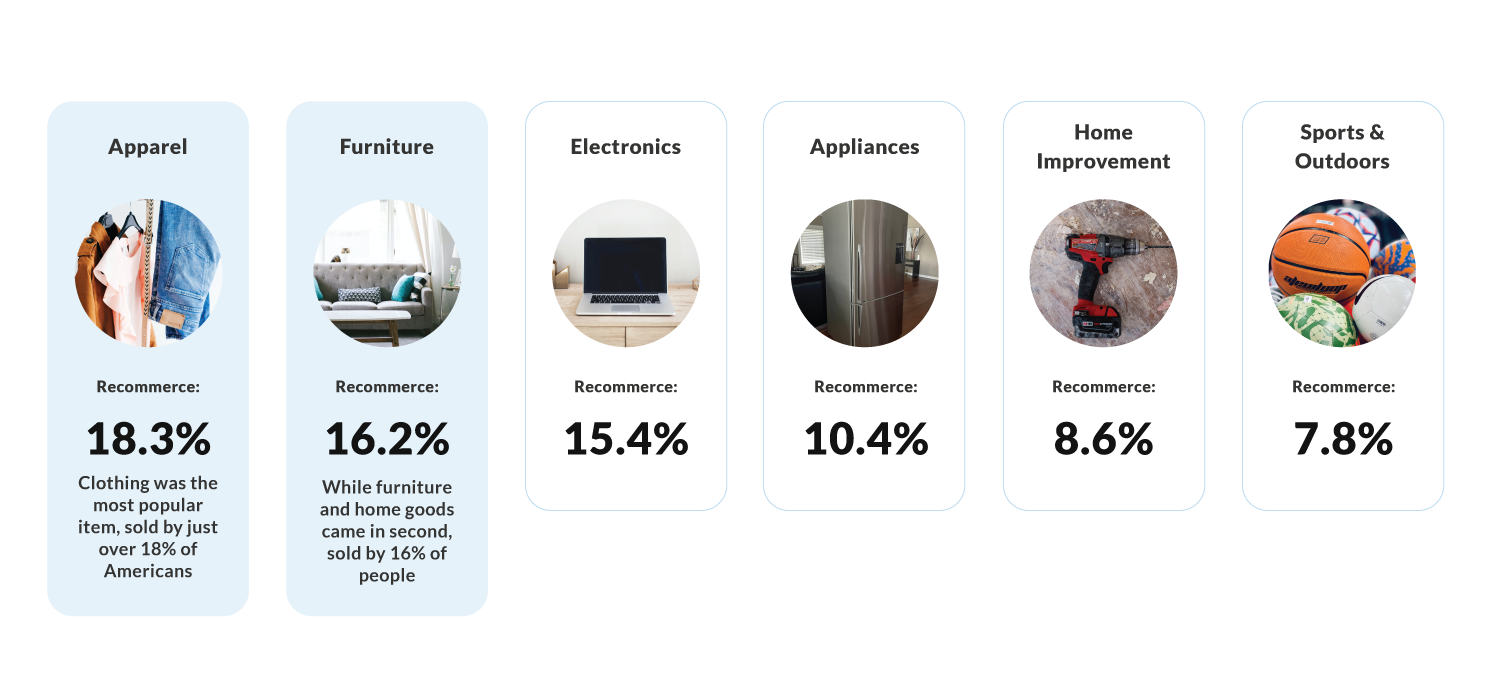

39% of Americans sold something on a resale site in the past year

These are the most popular selling categories

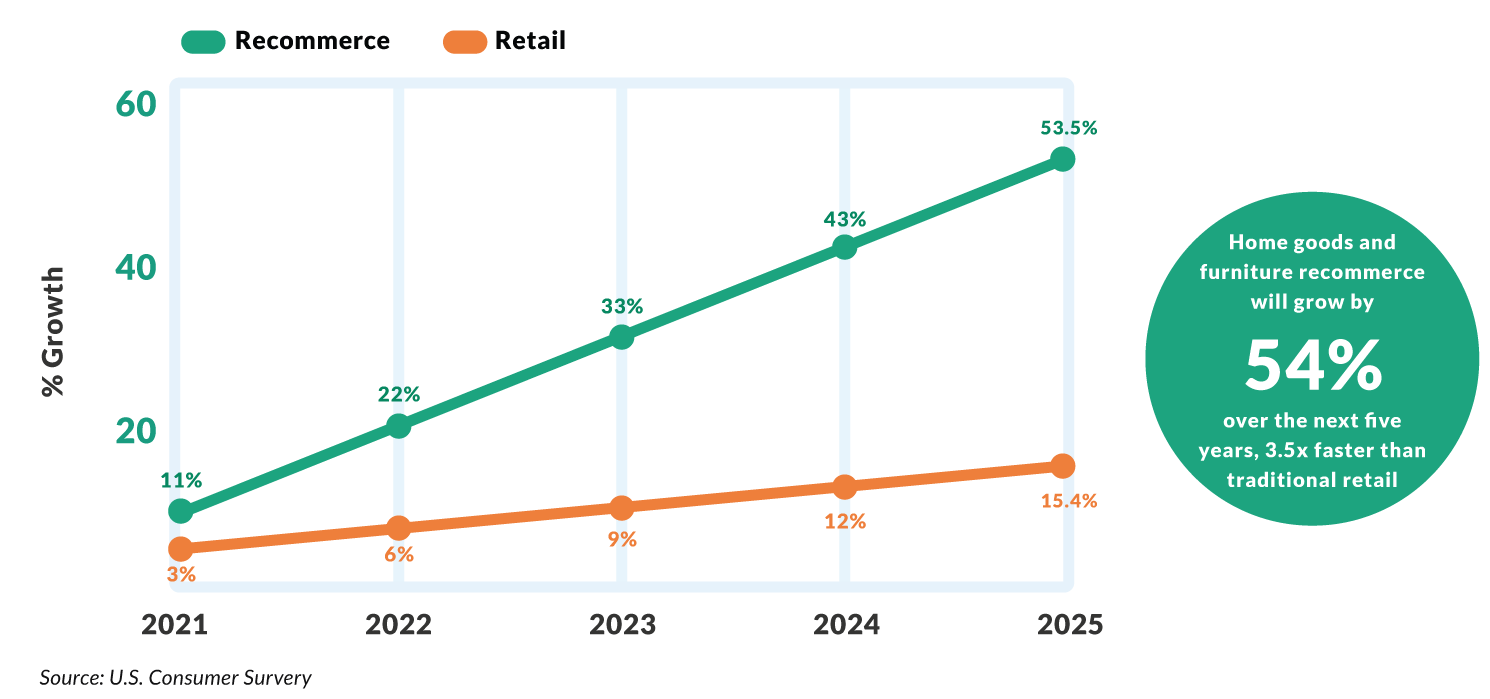

Recommerce Sales Expected To Outpace Retail in the Next Five Years

In 2020, recommerce grew faster than the overall market across all home categories, taking market share from traditional retailers

The Home Category was the Fastest Growing Recommerce Category in 2020

Fastest Growing Recommerce Categories Year over Year (2019–2020)

Interest in Apparel Resale Sharply Declined as Americans Spend Less on Clothes

2020 was the worst year on record for the retail apparel market

Increased Interest in Home Goods, Outdoors and Autos Drove OfferUp Growth

Home Goods & Furniture Recommerce Soars, Benefits From Increase in Home Spending

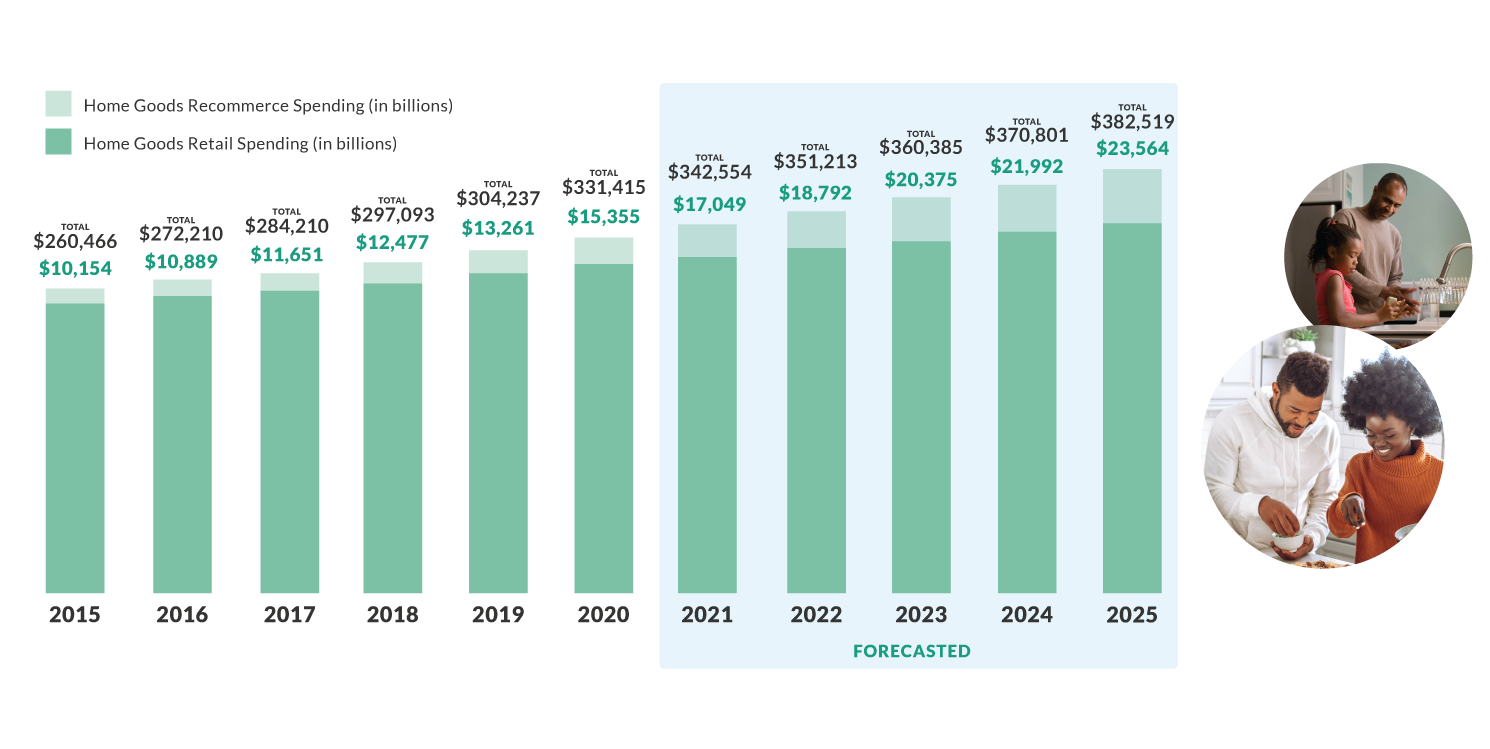

The Recommerce Market for Home is Projected to Hit $23.6B by 2025

Secondhand Goods Take Center Stage in the American Home

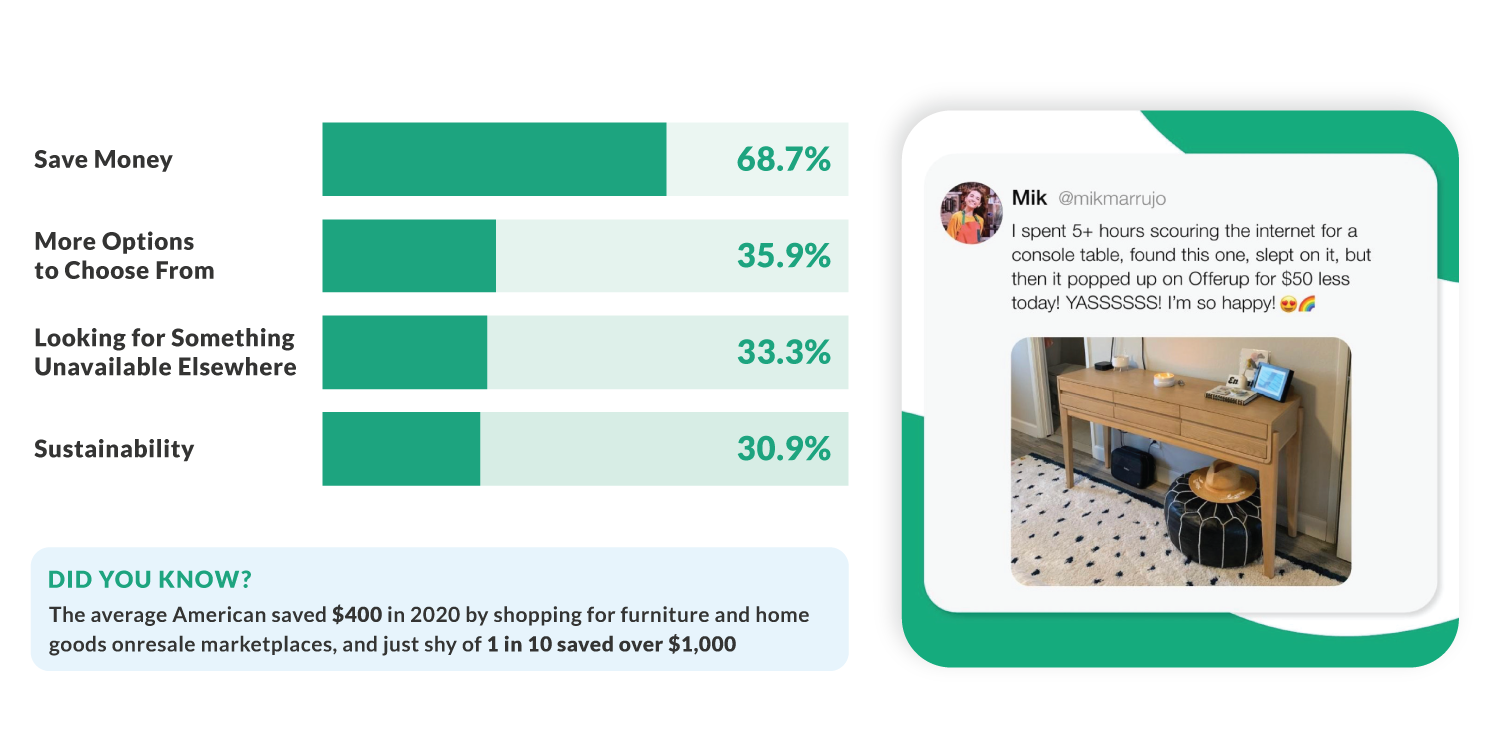

Top Reasons Why Americans Buy Secondhand Furniture & Home Goods

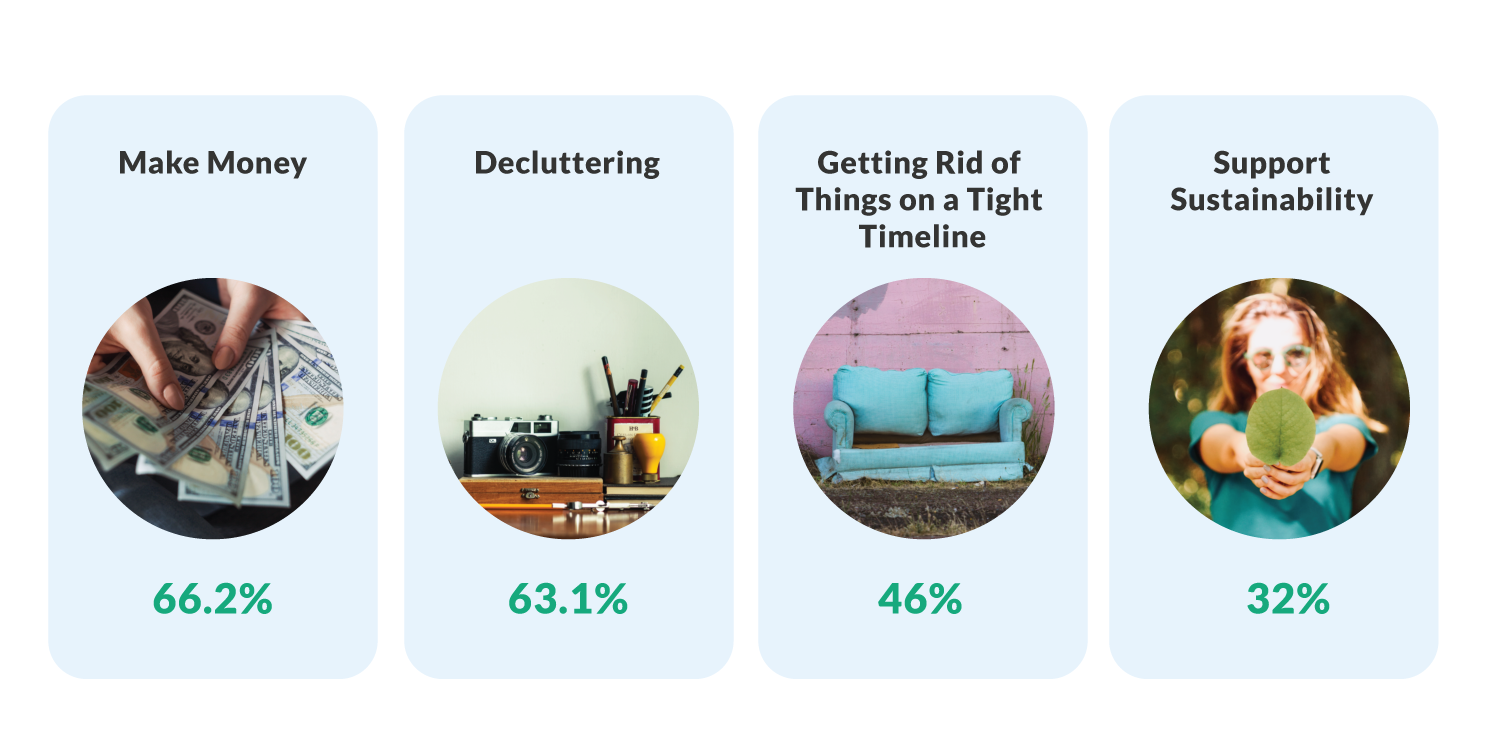

Top Reasons Why People Sell Secondhand Furniture and Home Goods

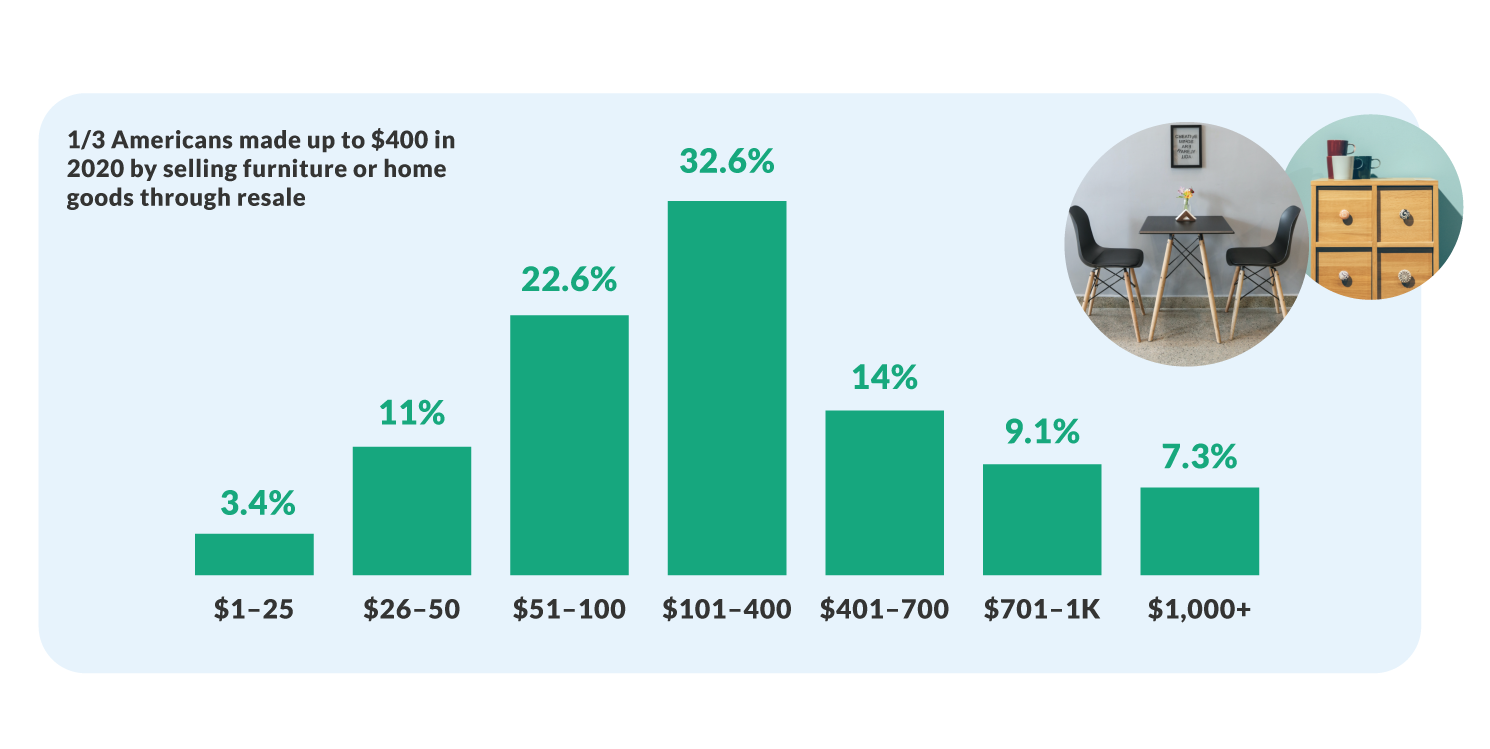

Did you know: The average seller made $368 selling furniture and home goods on resale marketplaces last year, and almost a third of sellers made

more than $400

Money Made by Selling Furniture and Home Goods on Resale Apps Over the Past Year

The Pandemic Made the Home an Investment Priority for Americans

With Americans spending more time at home, 58% said they redecorated their homes with furniture and home goods in 2020

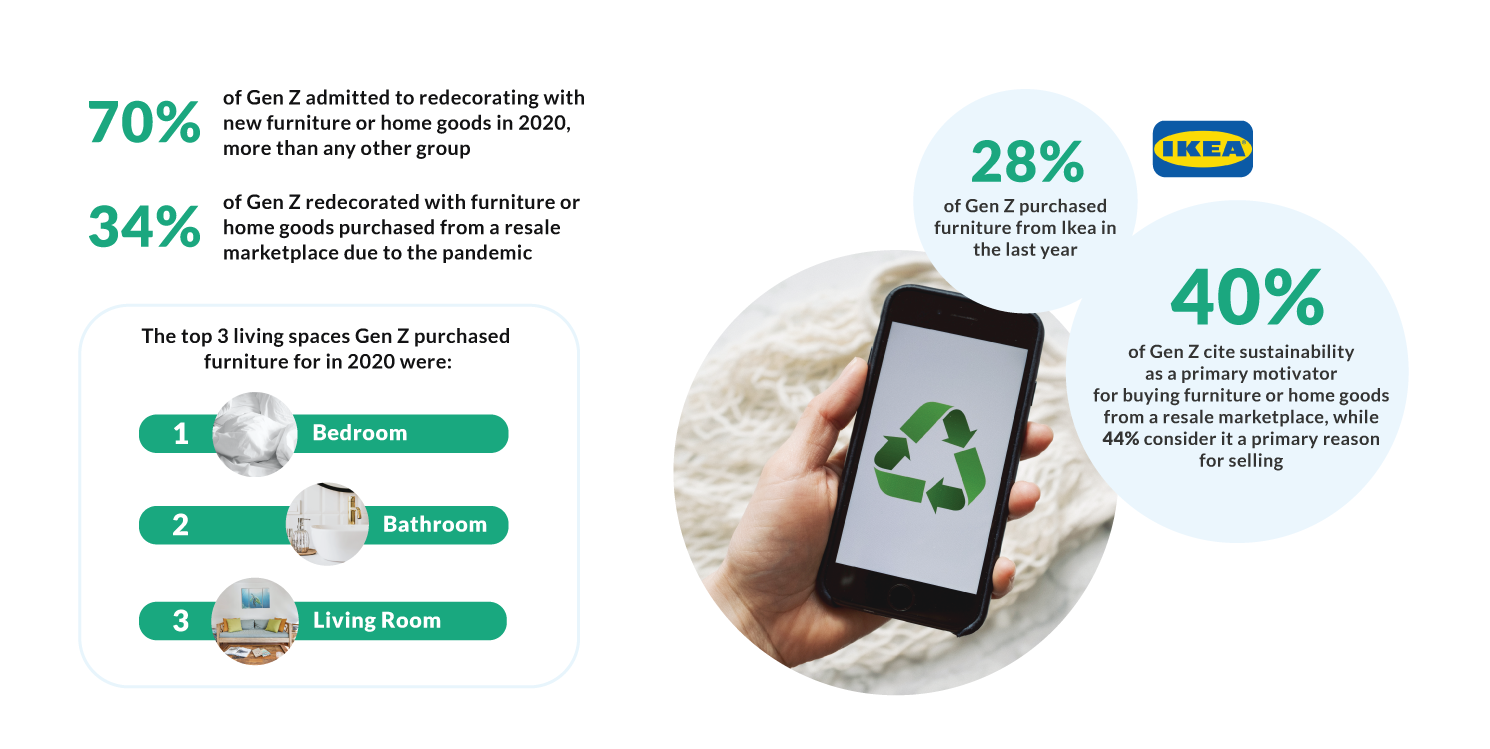

Gen Z Spent 2020 Redecorating Their Bedrooms

Sales for Almost All Furniture and Home Decor Categories Grew Compared to Previous Years

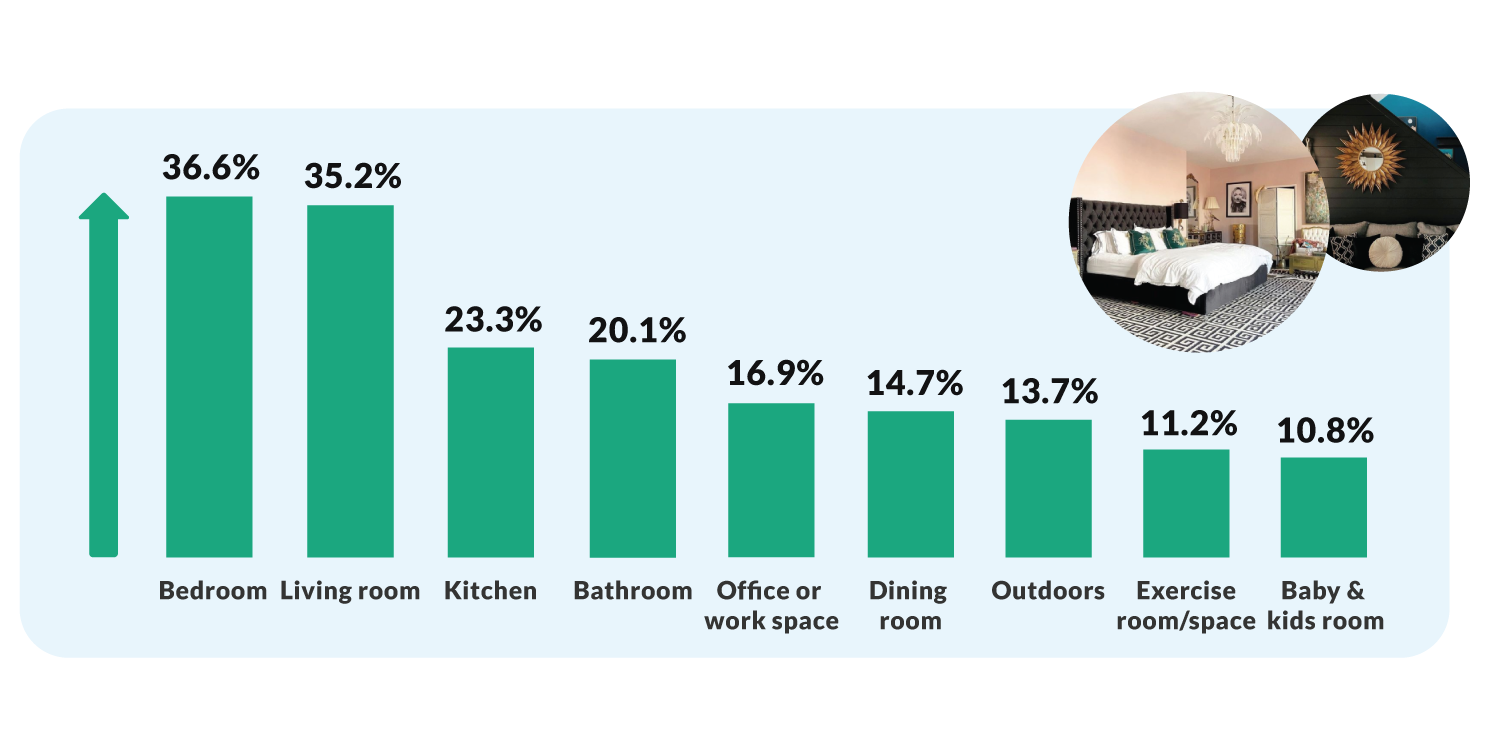

Nesting and comfort were essential in 2020, so it’s not surprising that the bedroom and living room were the top spaces shoppers purchased furniture for last year

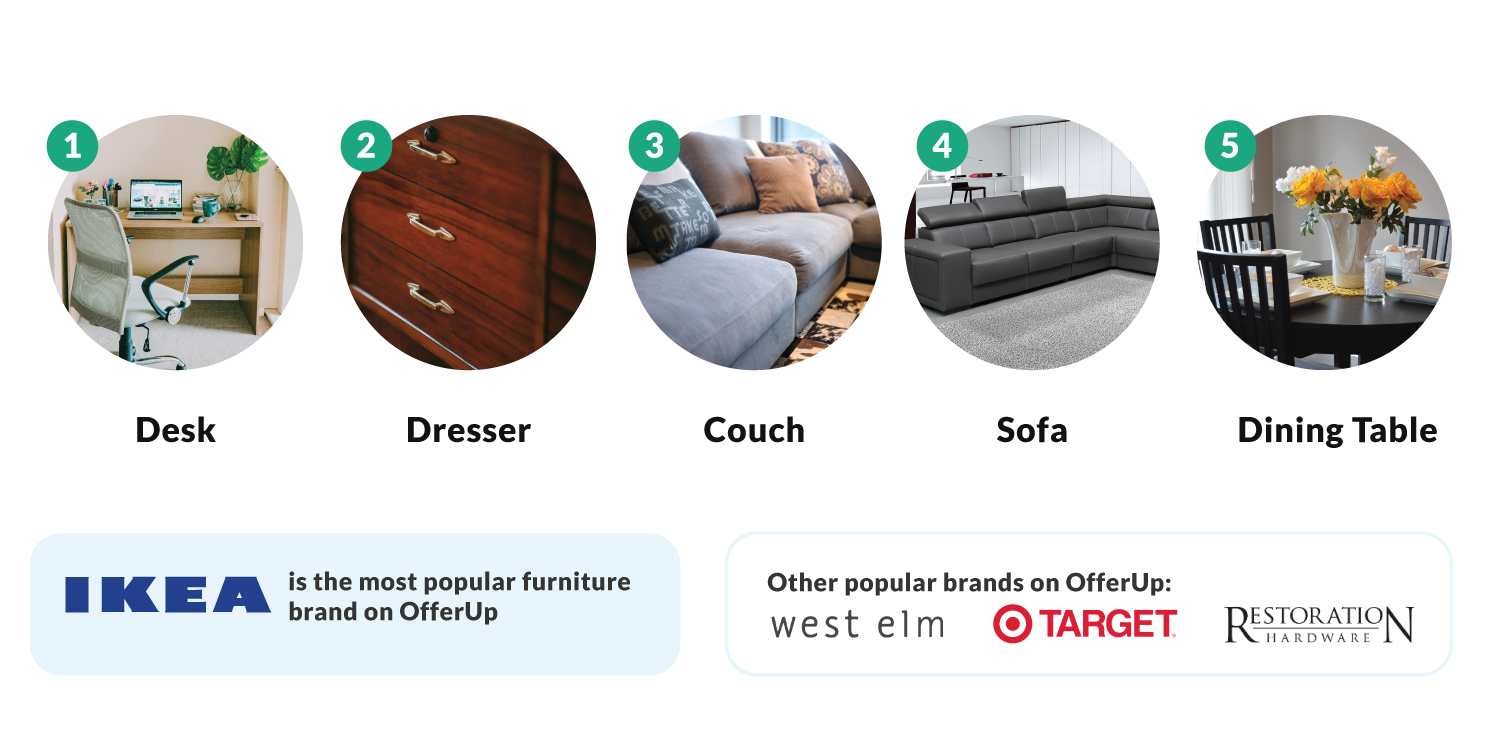

Most Searched Furniture Pieces on OfferUp in 2020

Most Searched Appliances on OfferUp in 2020

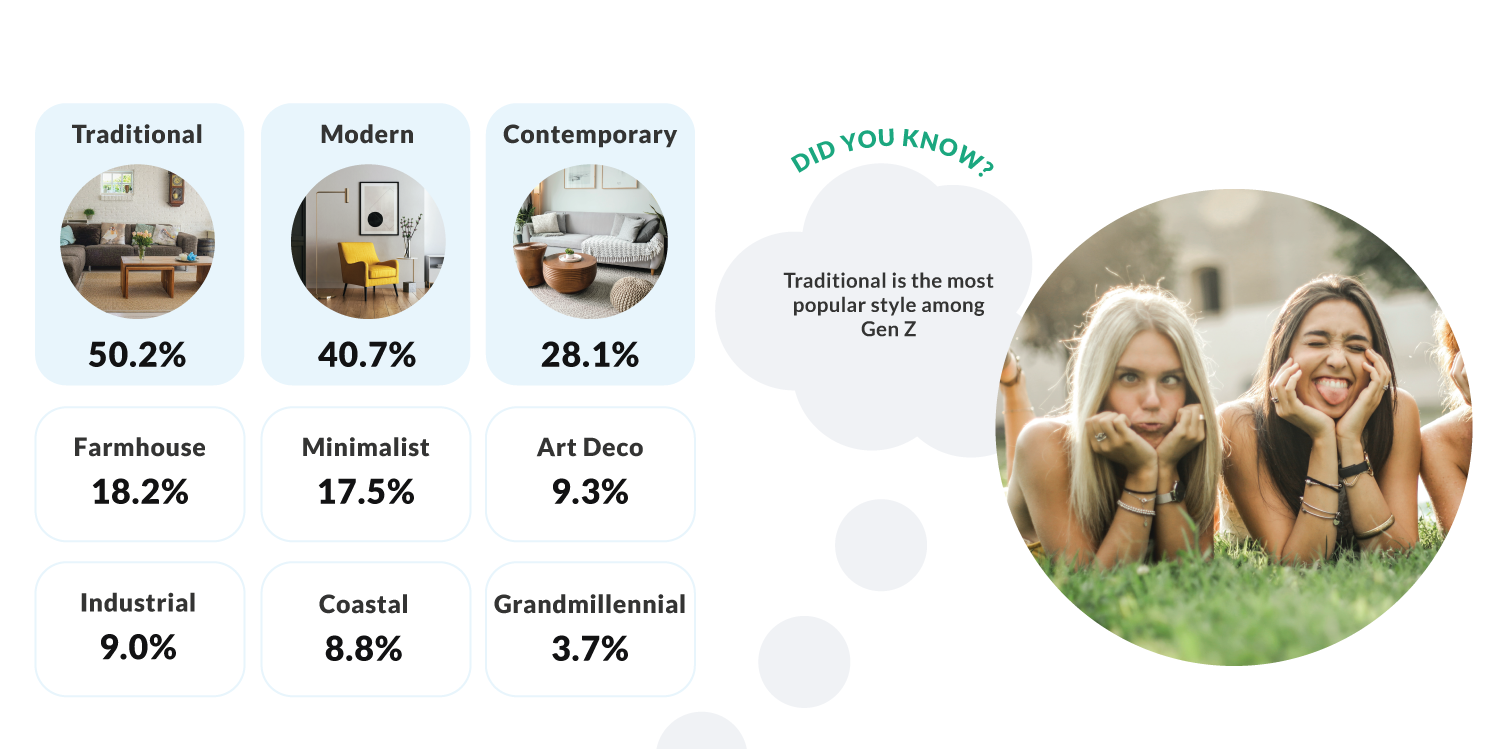

Traditional and Modern Are the Most Popular Design Styles

When it comes to decor, most consumers look for traditional or modern styles, closely followed by contemporary

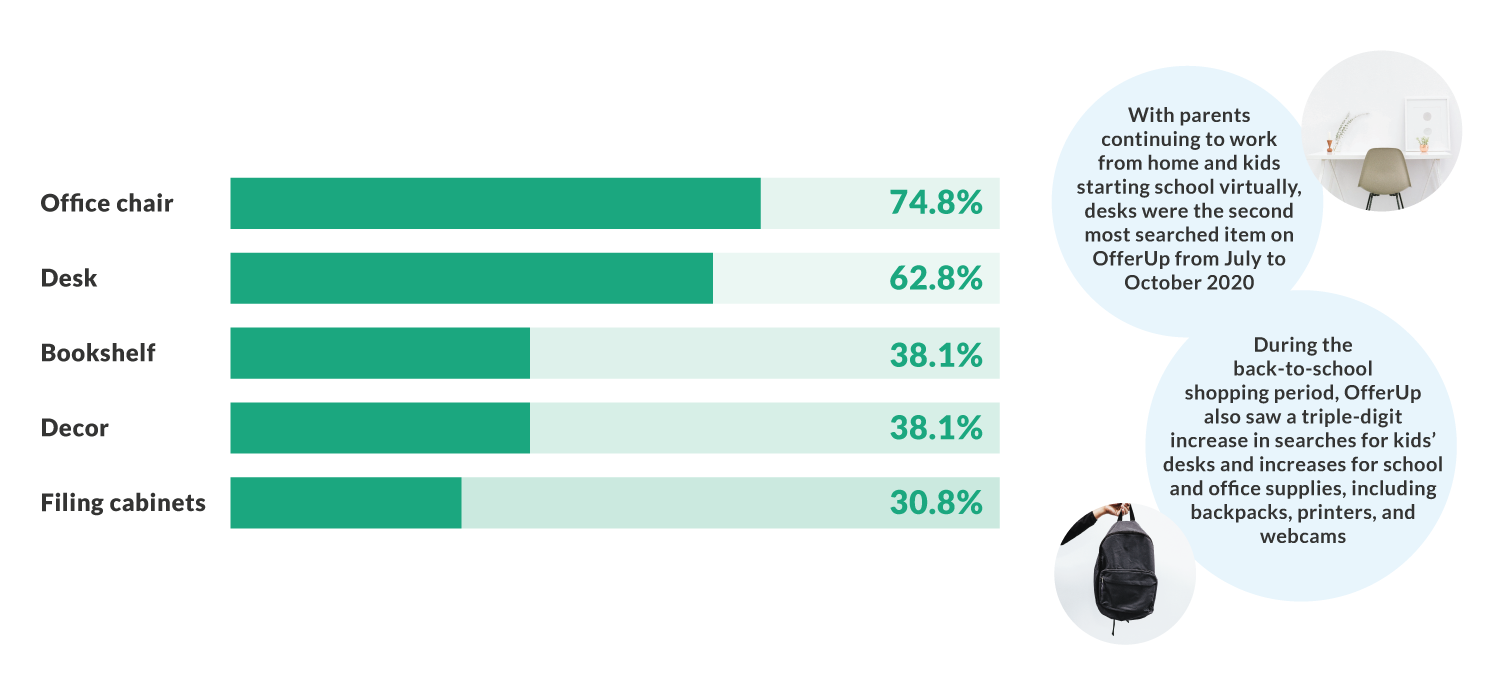

The New American Home Office and Digital School Headquarters

Sales of office furniture boomed during the pandemic as many workers left offices and started to work from home. The essentials — a good office chair and a desk — were the top two purchases

Home Workouts and Virtual Fitness Created a New Wave of Demand

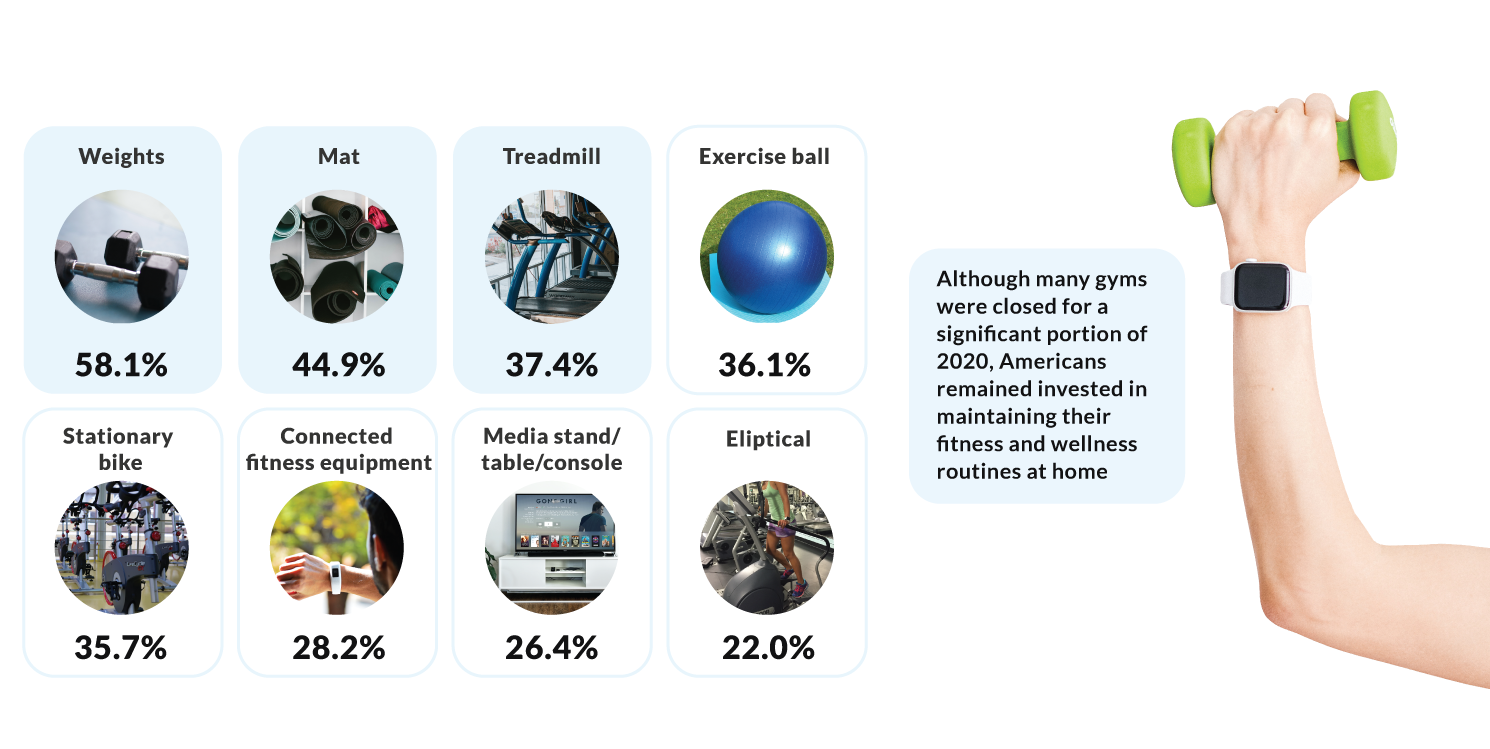

Percentage of Americans who purchased fitness gear, by category:

Many Americans Relied on Retail Marketplaces to Find the Equipment They Needed

The high demand for dumbells and other weight-lifting supplies led to retail shortages

The Pandemic Also Meant More People Moved and Sought Larger Spaces

Americans Are Financing Home Redecoration with Stimulus Checks and Tax Returns

Most Americans Are Still Obsessed With Decluttering

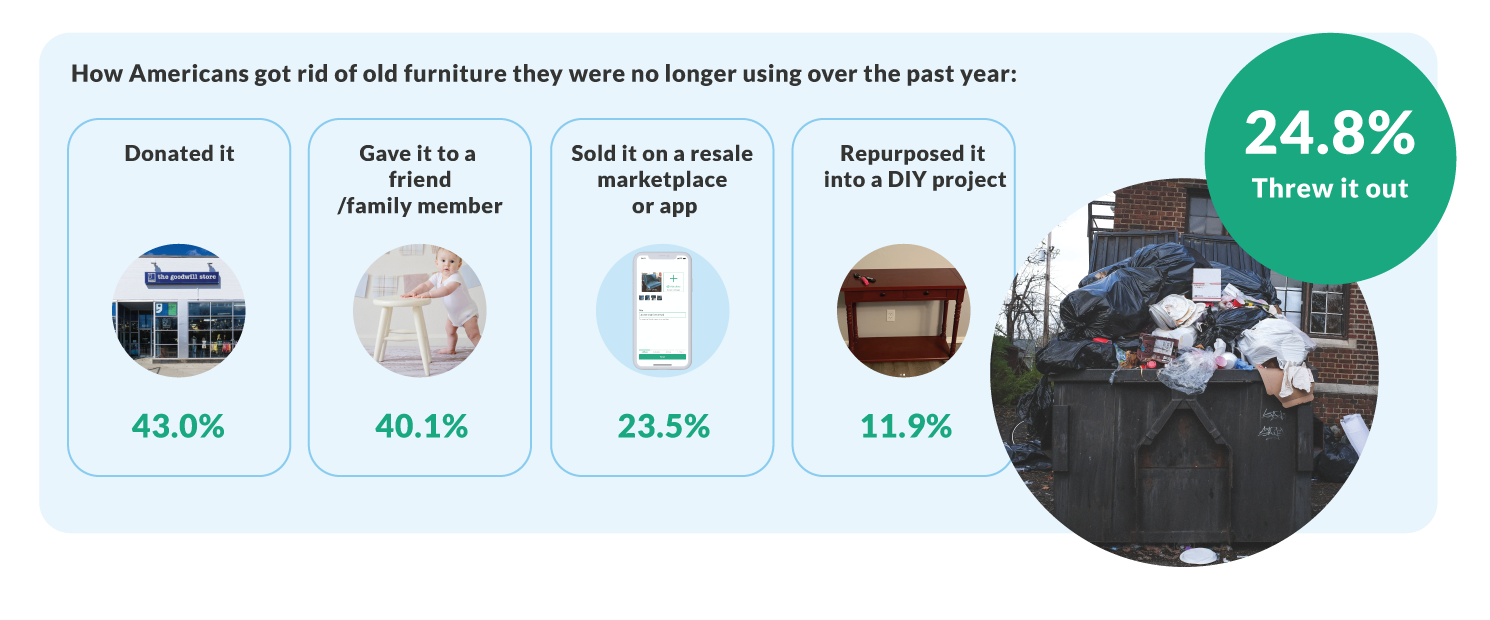

Around 83% of households got rid of some old furniture in the past year

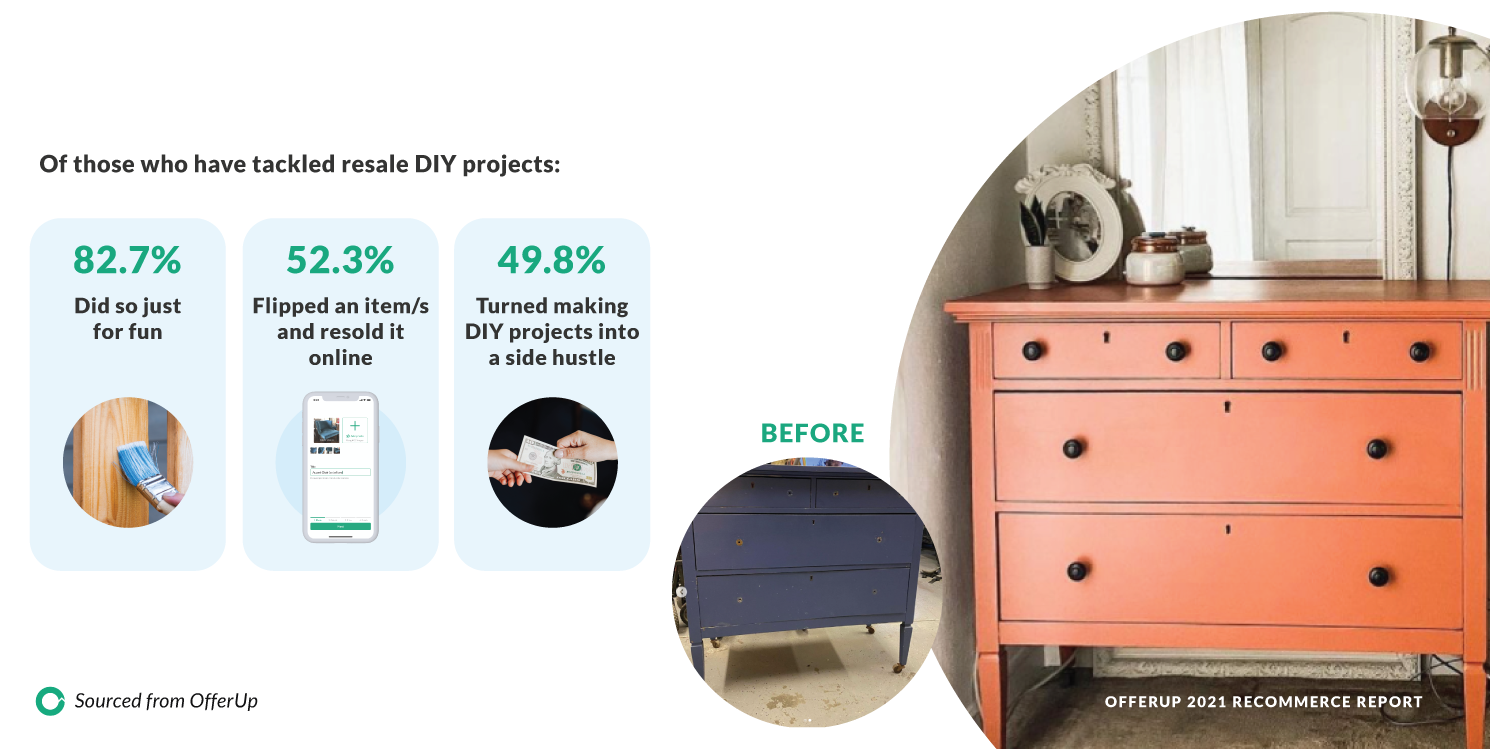

Why Buy It When You Can DIY It

Just under a third (30.4%) of Americans have bought resale home goods or furniture to turn it into a DIY project

Most Shoppers Expect to Shop Resale Even More Frequently

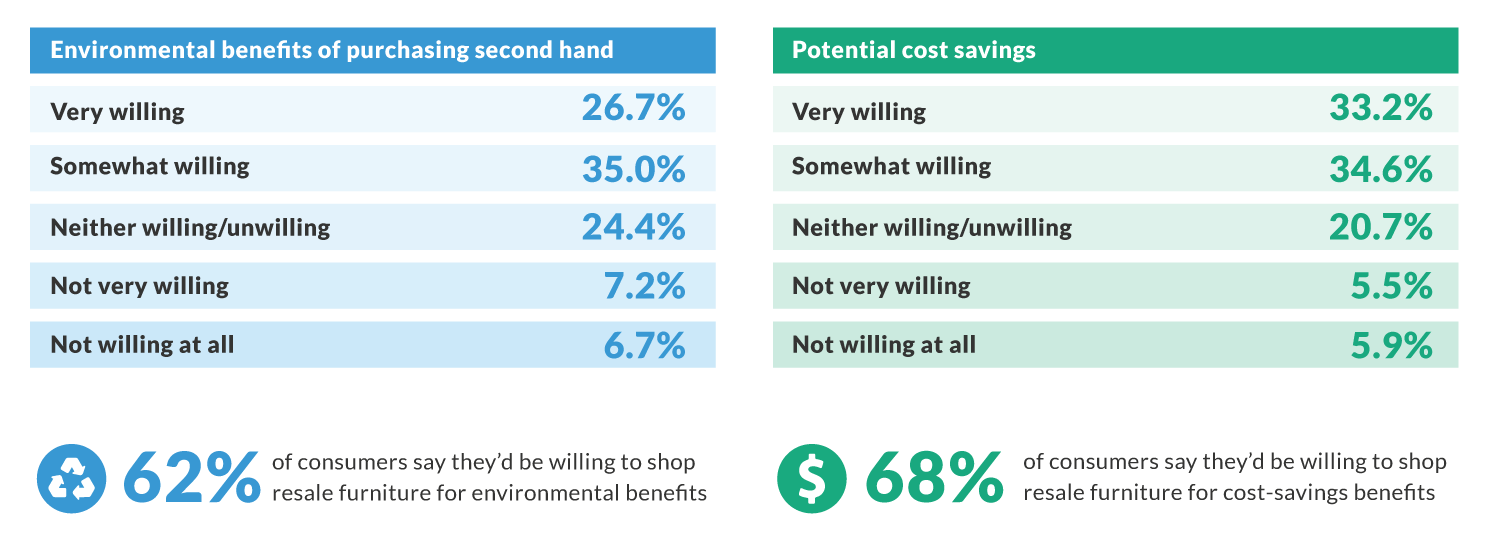

People Will Shop Resale if It Means Saving Money and the Environment

Percent of people willing to change their furniture and/or home goods purchasing habits by shopping on a resale marketplace or app like OfferUp, given the following:

Appendix

Methodology:

The OfferUp Recommerce Report includes research and data from retail analytics firm GlobalData. GlobalData uses consumer surveys, retailer tracking, official data, data sharing, store observation and secondary sources to analyze, model and calculate metrics including market and channel size, and market share.

Third-party online market research company Rep Data conducted a January 2021 survey of 2,020 Americans regarding recommerce in the furniture and home goods retail market.

Additional data sources include internal OfferUp community data and independent secondary research.

Definitions:

Recommerce refers to the process of selling previously owned new or used products.

Apparel includes all types of apparel and accessories across all segments: men, women and kids.

Autos include cars, trucks and other consumer automotive vehicles, plus vehicle/automotive parts.

Electronics include all consumer electronics from appliances to computing to audio visual.

Furniture/Home Goods includes all homewares and furniture; excludes home improvement, floor coverings, such as fitted carpets, tiled floors, fitted wooden floors, and home electronics such as televisions.

Home Improvement includes tools, home improvement materials, accessories and other home improvement products; excludes appliances and general homewares/furniture.

Sporting/Outdoors includes all sporting equipment, sporting accessories, exercise equipment, including bikes; excludes automotive transportation and sporting apparel.